All Categories

Featured

Table of Contents

One more opportunity is if the deceased had a current life insurance coverage policy. In such situations, the marked recipient might receive the life insurance policy proceeds and make use of all or a part of it to repay the home loan, allowing them to stay in the home. home loan with insurance cover. For individuals who have a reverse mortgage, which enables individuals aged 55 and over to get a home loan based upon their home equity, the financing interest builds up with time

Throughout the residency in the home, no repayments are called for. It is vital for individuals to meticulously intend and take into consideration these factors when it involves home mortgages in Canada and their effect on the estate and successors. Looking for assistance from legal and economic experts can aid make sure a smooth change and proper handling of the home mortgage after the home owner's passing.

It is vital to comprehend the readily available selections to guarantee the home mortgage is appropriately dealt with. After the death of a homeowner, there are a number of options for home mortgage settlement that rely on numerous factors, including the regards to the mortgage, the deceased's estate planning, and the desires of the heirs. Right here are some common options:: If multiple beneficiaries want to assume the home mortgage, they can become co-borrowers and proceed making the mortgage repayments.

This choice can offer a clean resolution to the home loan and distribute the remaining funds amongst the heirs.: If the deceased had a current life insurance coverage policy, the marked beneficiary may receive the life insurance policy proceeds and use them to settle the home mortgage (mortgage protection insurance price). This can make it possible for the beneficiary to remain in the home without the concern of the home mortgage

If no person remains to make mortgage repayments after the homeowner's death, the home mortgage creditor has the right to seize on the home. However, the influence of foreclosure can differ depending on the circumstance. If a beneficiary is called but does not offer your home or make the home loan repayments, the home loan servicer might launch a transfer of ownership, and the repossession can drastically harm the non-paying heir's credit.In cases where a home owner passes away without a will or trust, the courts will assign an administrator of the estate, normally a close living relative, to distribute the properties and responsibilities.

Mortgage Protection Insurance Agent Salary

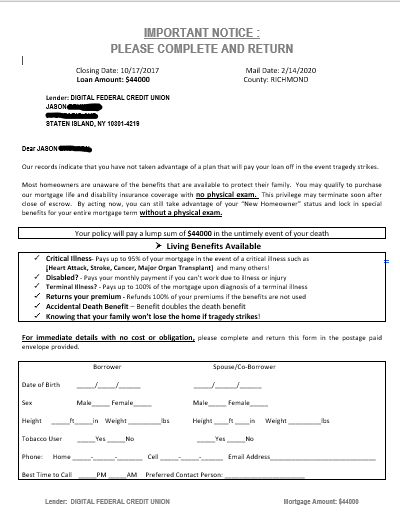

Home loan defense insurance coverage (MPI) is a form of life insurance policy that is especially made for people who want to make certain their home mortgage is paid if they pass away or come to be disabled. Sometimes this kind of policy is called mortgage payment security insurance coverage.

When a bank has the large bulk of your home, they are liable if something happens to you and you can no longer pay. PMI covers their threat in the event of a repossession on your home (mortgage and life assurance). On the various other hand, MPI covers your threat in case you can no much longer make payments on your home

The amount of MPI you need will certainly vary depending on your distinct situation. Some aspects you must take right into account when considering MPI are: Your age Your health and wellness Your financial circumstance and sources Various other kinds of insurance that you have Some people might think that if they presently have $200,000 on their home mortgage that they should acquire a $200,000 MPI policy.

Mortgage Protection Insurance If You Lose Your Job

The inquiries people have concerning whether or not MPI is worth it or not are the very same questions they have about buying other kinds of insurance in basic. For many people, a home is our single largest debt.

The combination of anxiety, sadness and transforming household dynamics can cause even the very best intentioned people to make costly mistakes. do i need life insurance to take out a mortgage. MPI resolves that problem. The value of the MPI plan is straight tied to the equilibrium of your mortgage, and insurance coverage earnings are paid directly to the financial institution to deal with the continuing to be equilibrium

And the biggest and most difficult monetary concern encountering the making it through family members is fixed quickly. If you have health and wellness problems that have or will certainly produce issues for you being authorized for routine life insurance policy, such as term or whole life, MPI could be an exceptional choice for you. Normally, home loan defense insurance plan do not call for medical examinations.

Historically, the quantity of insurance protection on MPI plans dropped as the equilibrium on a home loan was minimized. Today, the insurance coverage on the majority of MPI plans will certainly continue to be at the same degree you acquired. For example, if your original mortgage was $150,000 and you acquired $150,000 of home mortgage protection life insurance policy, your beneficiaries will now receive $150,000 despite just how much you owe on your mortgage - mms mortgage protection.

If you want to settle your mortgage early, some insurer will enable you to convert your MPI plan to another sort of life insurance. This is one of the concerns you could want to deal with in advance if you are taking into consideration paying off your home early. Expenses for home mortgage defense insurance will certainly vary based upon a number of things.

Home Loan With Insurance

An additional factor that will influence the costs amount is if you purchase an MPI plan that gives coverage for both you and your partner, providing benefits when either among you passes away or ends up being handicapped. Know that some companies may require your policy to be reissued if you re-finance your home, yet that's typically only the situation if you got a policy that pays just the balance left on your mortgage.

What it covers is really narrow and clearly specified, depending on the options you select for your specific policy. If you pass away, your home loan is paid off.

For home mortgage security insurance policy, these kinds of extra coverage are included on to policies and are recognized as living benefit riders. They enable policy holders to touch right into their home loan defense advantages without passing away.

For cases of, this is normally currently a complimentary living benefit supplied by many business, but each company specifies advantage payouts in a different way. This covers health problems such as cancer cells, kidney failing, heart strikes, strokes, mental retardation and others. home loan death insurance. Companies typically pay out in a lump sum depending upon the insured's age and severity of the ailment

Unlike many life insurance policy plans, purchasing MPI does not call for a clinical test much of the time. This indicates if you can not get term life insurance coverage due to a health problem, a guaranteed issue home mortgage protection insurance coverage policy might be your finest bet.

When possible, these must be people you understand and depend on who will certainly give you the very best recommendations for your situation. No matter of that you decide to check out a plan with, you ought to constantly look around, since you do have choices - how does homeowners insurance work with a mortgage. In some cases, unintentional death insurance is a much better fit. If you do not receive term life insurance policy, then unintended fatality insurance might make even more sense due to the fact that it's assurance issue and indicates you will not go through medical examinations or underwriting.

Insurance To Pay Off Mortgage If You Die

Make certain it covers all costs associated to your mortgage, consisting of passion and settlements. Consider these elements when determining exactly just how much insurance coverage you think you will certainly need. Ask exactly how rapidly the policy will be paid out if and when the primary earnings earner dies. Your household will be under sufficient emotional stress without having to wonder the length of time it might be prior to you see a payment.

Table of Contents

Latest Posts

Life Insurance To Pay For Funeral

Funeral Plan Calculator

Funeral Cover Plans

More

Latest Posts

Life Insurance To Pay For Funeral

Funeral Plan Calculator

Funeral Cover Plans